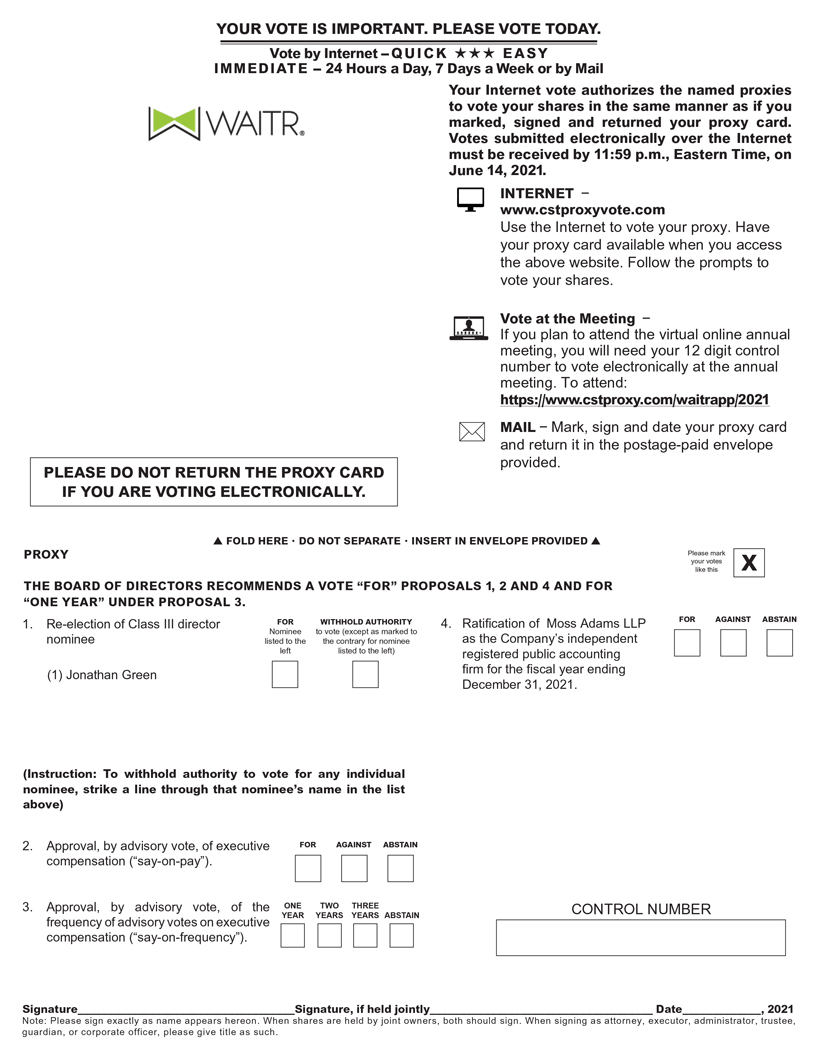

PROPOSAL NO. 4 – RATIFICATION OF THE SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 and recommends that stockholders vote for ratification of such selection. Although we arewould not required by law to obtain such ratification from our stockholders, we have determined that it is desirable to do so. If our stockholders do not ratify the selection of Moss Adams LLP, the Audit Committee may reconsider its selection. The Audit Committee, in its discretion, may appoint a new independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company andor our stockholders.

Moss Adams LLP has audited our consolidated financial statements since 2018. We expect that representatives of Moss Adams LLP will be present at the Annual Meetingstockholders to respond to appropriate questions and to make a statement if they so desire.

Principal Accountant Fees and Services

The following table shows the fees for professional services rendered to the Company by Moss Adams LLP for services in respect of the years ended December 31, 2020 and 2019.effect such reverse stock split.

| | | | | | | | |

| | | 2020 | | | 2019 | |

Audit Fees (1) | | $ | 873,026 | | | $ | 1,046,152 | |

Audit-Related Fees (2) | | | — | | | | — | |

Tax Fees (3) | | | — | | | | — | |

All Other Fees (4) | | | — | | | | — | |

| | | | | | | | |

Total Fees | | $ | 873,026 | | | $ | 1,046,152 | |

| | | | | | | | |

Risks Associated with the Reverse Stock Split

We cannot predict whether the reverse stock split, if completed, will increase the market price for our common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

(1) | Audit fees include fees associated with ·

| the annual auditmarket price per share would either exceed or remain in excess of the $1.00 minimum bid price per share as required to maintain the listing of our consolidated financial statements,common stock on the reviewsNasdaq Capital Market; |

| · | we would otherwise meet the requirements for continued listing of our interim condensed consolidated financial statements, accounting and financial reporting consultations, andcommon stock on the issuanceNasdaq Capital Market; |

| · | the market price per share of consent and comfort lettersour common stock after the reverse stock split would rise in connection with registration statement filings with the SEC, and all services that are normally provided by the accounting firm in connection with statutory and regulatory filings or engagements. Audit fees in 2019 also consisted of professional services relatedproportion to the auditreduction in the number of fair value forshares outstanding before the Bite Squad Merger. |

(2) | Audit-related fees pertain to professional services for assurance and related services that are reasonably related to the performance of the audit of our financial statements and are not reported under “Audit fees.” These services include services and consultations related to the Company’s registration statements.

|

(3) | Tax fees include fees for tax compliance, tax advice and tax planning.

|

(4) | All other fees consist of permitted services other than those that meet the criteria described above.

reverse stock split; |

All

| · | the reverse stock split would result in a per-share price that would attract brokers and investors who do not trade in lower-priced stocks; |

| · | the reverse stock split would result in a per-share price that would increase our ability to attract and retain employees and other service providers; or |

| · | the reverse stock split would promote greater liquidity for our stockholders with respect to their shares. |

In addition, the reverse stock split would reduce the number of outstanding shares of our common stock without reducing the number of shares of authorized common stock, thereby increasing the number of available and unissued shares of common stock. Therefore, the number of shares of our common stock that are authorized and unissued will increase relative to the number of issued and outstanding shares of our common stock following the reverse stock split. The Board may authorize the issuance of the professional services described above were pre-approvedremaining authorized and unissued shares without further stockholder action for a variety of purposes, except as such stockholder approval may be required in particular cases by our Certificate of Incorporation, applicable law or the rules of any stock exchange on which our securities may then be listed. The issuance of additional shares would be dilutive to our existing stockholders and may cause a decline in the trading price of our common stock.

The market price of our common stock is based on our performance and other factors, some of which are unrelated to the number of shares outstanding. If the reverse stock split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a reverse stock split.

Principal Effects of the Reverse Stock Split on the Market for Our Common Stock

On August 5, 2022, the closing bid price for our common stock on the Nasdaq Capital Market was $0.47 per share. By decreasing the number of shares of our common stock outstanding without altering the aggregate economic interest represented by the Audit Committeeshares, we believe the market price would be increased. The greater the market price rises above $1.00 per share, the less risk there would be that we would fail to meet the requirements for maintaining the listing of our common stock on the Nasdaq Capital Market. However, there can be no assurance that the market price of the common stock would rise to or were pre-approvedmaintain any particular level or that we would at all times be able to meet the requirements for maintaining the listing of our common stock on the Nasdaq Capital Market.

Principal Effects of the Reverse Stock Split on Our Common Stock; No Fractional Shares

If our stockholders approve granting our Board the authority to amend our Certificate of Incorporation to effect a reverse stock split, and if our Board decides to effectuate such amendment, the principal effect of the amendment would be to reduce the number of issued and outstanding shares of our common stock, in accordance with the Audit Committee Pre-Approval Policy. The Audit Committee was provided with regular updatesSplit Ratio Range, from 190,780,722 shares as of the record date to between and including 38,156,144 shares and 9,539,036 shares. If the reverse stock split is effectuated, the total number of shares of our common stock each stockholder holds would be reclassified automatically into the number of shares of our common stock equal to the naturenumber of shares of our common stock each stockholder held immediately before the reverse stock split divided by the ratio approved by Board within the Split Ratio Range.

Effecting the reverse stock split will not change the total authorized number of shares of our common stock. However, the reduction in the issued and outstanding shares would provide more authorized shares available for future issuance.

The reverse stock split would affect all of our stockholders uniformly and would not affect any stockholder’s percentage ownership interests, except to the extent that the reverse stock split results in such servicesstockholder owning a fractional share. We expect that after the amendment to our Certificate of Incorporation is filed, Continental, our transfer agent, would aggregate all fractional shares and fees paidarrange for such services.

Nonethem to be sold at the then-prevailing prices on the open market on behalf of those stockholders who would otherwise be entitled to receive a fractional share. We expect that the transfer agent would cause the sale to be conducted in an orderly fashion at a reasonable pace and that it may take several days to sell all of the hours expendedaggregated fractional shares of our common stock. After completing the sale, stockholders would receive a cash payment from the transfer agent in an amount equal to their pro rata shares of the total net proceeds of these sales. The proceeds would be subject to certain taxes as discussed below. In addition, stockholders would not be entitled to receive interest for the period of time between the filing of the amendment to the Certificate of Incorporation and the date a stockholder receives payment for the cashed-out shares. The payment amount would be paid to the stockholder in the form of a check in accordance with the procedures outlined below.

After the reverse stock split, a stockholder would have no further interest in the Company with respect to such stockholder’s cashed-out fractional shares. A person otherwise entitled to a fractional interest would not have any voting, dividend or other rights except to receive payment as described above.

Principal Effects of the Reverse Stock Split on Outstanding Options and Warrants

As of the record date, we had outstanding (i) stock options to purchase an aggregate of 9,632,717 shares of our common stock with exercise prices ranging from $0.04 to $9.05 per share and (ii) warrants to purchase an aggregate of 586,845 shares of our common stock with exercise prices of $8.52 per share. Under the terms of the stock options and warrants, when the reverse stock split becomes effective, the number of shares of our common stock covered by each of them would be divided by the number of shares being combined into one share of our common stock in the reverse stock split and the exercise or conversion price per share would be increased to a dollar amount equal to the current exercise or conversion price, multiplied by the number of shares being combined into one share of our common stock in the reverse stock split. This results in the same aggregate price being required to be paid upon exercise as was required immediately preceding the reverse stock split. The number of shares reserved under the 2018 Incentive Plan would decrease by the ratio approved by the Board within the Split Ratio Range.

Principal Effects of the Reverse Stock Split on Legal Ability to Pay Dividends

Our Board has not declared, nor does it have any plans to declare in the foreseeable future, any distributions of cash, dividends or other property, and we are not in arrears on any dividends. Therefore, we do not believe that the reverse stock split would have any effect with respect to future distributions, if any, to holders of our common stock.

Accounting Matters

The reverse stock split would not affect the par value of our common stock or preferred stock, which would remain unchanged at $0.0001 per share. As a result, on the independenteffective date of the reverse stock split, the stated capital on our balance sheet attributable to our common stock would be reduced by the ratio approved by the Board within the Split Ratio Range, and the additional paid-in capital account would be credited with the amount by which the stated capital is reduced. The per-share net income or loss and per-share net book value of our common stock would be increased because there would be fewer shares of our common stock outstanding.

Beneficial Holders of Our Common Stock (Stockholders Who Hold in “Street Name”)

Upon the reverse stock split, we intend to treat shares held by stockholders in “street name,” through a broker, in the same manner as registered public accounting firm’s engagementstockholders whose shares are registered in their names. Brokers would be instructed to auditeffect the Company’s financial statementsreverse stock split for their beneficial holders holding our common stock in “street name.” However, brokers may have different procedures than registered stockholders for processing the reverse stock split and making payment for fractional shares. Stockholders holding shares of our common stock with a broker and having any questions in this regard should contact their broker.

Registered “Book-Entry” Holders of Our Common Stock

If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse stock split shares or cash payment in lieu of any fractional share interest, if applicable. If such a stockholder is entitled to post-reverse stock split shares, a transaction statement would automatically be sent to such stockholder’s address of record indicating the number of shares of our common stock held following the reverse stock split.

If such a stockholder is entitled to a payment in lieu of any fractional share interest, a check would be mailed to the stockholder’s registered address as soon as practicable after the effective time of the reverse stock split. By signing and cashing the check, stockholders would warrant that they owned the shares of our common stock for which they received a cash payment. The cash payment is subject to applicable federal and state income tax and state abandoned property laws. No stockholders would be entitled to receive interest for the most recent fiscal year were attributedperiod of time between the effective time of the reverse stock split and the date payment is received.

No Dissenters’ Rights

Under the DGCL, stockholders are not entitled to work performed by persons other thandissenters’ rights with respect to the independent registered public accounting firm’s full-time permanent employees.reverse stock split.

Policy on Pre-Approval

Interests of Services Performed by Independent Registered Public Accounting FirmDirectors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their ownership of shares of our common stock. See “Security Ownership of Certain Beneficial Owners, Directors and Management” below.

Material Federal Income Tax Consequences of the Reverse Stock Split

The Audit Committee is responsible for appointing, setting compensation and overseeing the workfollowing summary describes certain material U.S. federal income tax consequences of the independent auditors. In recognitionreverse stock split to holders of our common stock.

For purposes of this responsibility,summary a “non-U.S. holder” is any beneficial owner of our common stock that is not a “U.S. holder.” A “U.S. holder” is any of the Audit Committee shall review and, in its sole